Insurance is a necessary evil. Health insurance, car insurance, and homeowner’s insurance are all dauntingly expensive things to keep track of because they benefit from the effects of the “What if…” And what thing is more daunting and expensive than traveling? Hence, we have travel insurance.

Now, travel insurance might seem like something too tricky to figure out; but with our guide, you’ll be able to pick the best insurance for you while being aware of all the variables that go into the pricing.

We use qualifiers, like “can,” throughout the article because every travel insurance option is different. They vary in what circumstances are covered, reimbursed, and so on. We encourage you to read into some of the travel insurance options we recommend and choose the one that best fits you.

So, without further ado, let’s get right into it!

What is Travel Insurance?

Travel insurance provides you peace of mind when it comes to the unexpected on your journeys abroad. Because most United States health insurances don’t extend outside U.S. borders, travel insurance is needed for people who want to prepare for the worst case scenario.

If your plans seem uncertain or diverse, it is important that you get travel insurance.

Sometimes if you’re going on a cruise or are booking a group tour, those vacations will require you to get a certain level of travel insurance before you go on your trip.

For these examples, there are representatives who offer you options to bundle the insurance with your trip cost when you book. Even in these instances, it is wise to still shop around for a policy that might better suit you.

There are four categories of travel insurance:

- Trip cancellation

- Accidental death or amputation

- Emergency medical assistance

- Baggage and personal effect

Each of these have their own variables when it comes to what is and what isn’t covered under the travel insurance.

No matter what, though, travel insurance never covers losses due to circumstances you can control, like if you change your mind or get too afraid to fly. With that in mind, let’s see what travel insurance does cover.

What Does Travel Insurance Financially Cover?

There are many umbrellas underneath the four aforementioned categories that dive deeper into what travel insurance covers and/or will reimburse you for. So, let’s take a look, starting with trip cancellation

Trip Cancellation

Covered situations can include:

- Illness or injury

- Death of a family member or traveling companion

- Job loss or unplanned jury duty

- Military deployment

- Things beyond your control, like a natural disaster or an airline strike

Reimbursement could cover a refund of airline tickets, rooming costs, rental vehicles, and other prepaid expenses. And these reimbursements can range from 50% to 75%.

Trip Delay

If your trip is delayed due to weather or airline maintenance, your travel insurance can cover your food, lodging, and transportation in the interim.

Your policy will detail the amount of time your flight can be delayed in order for you to collect on your coverage. This coverage usually comes in the form of daily payouts to each covered traveler. You will have to file a claim for reimbursement, so be sure to save your receipts!

Trip Interruption

If your trip ends prematurely, you can be reimbursed for non-refundable expenses. Reasons for a trip interruption that is covered includes a family emergency back home or the illness of one or more travelers in your group.

Some travel insurances will also cover the tickets for your early flight home.

Baggage Loss

While it is the airline’s responsibility to compensate you if your luggage is lost, your travel insurance could possibly have a higher benefit.

On top of that, travel insurance can cover the loss of your passport, baggage, and possessions, even if they’re damaged or stolen. However, there is usually no reimbursement for cash, expensive jewelry, or family heirlooms.

Medical Expenses/Emergency Evacuation

Unlike health insurance, travel insurance can cover doctor’s fees and hospital bills abroad. It can also make sure you get care at a U.S.-approved hospital.

Let’s move on to some options available to you, as well as what travel insurance costs.

Where Can I Get Travel Insurance, and Will I Be Poor After I Buy Some?

Firstly, we recommend that you use this incredible tool called SquareMouth to compare different travel plans.

By entering your trip and traveler information, SquareMouth can find the best insurance options for you. Each one has its pros and cons, so be sure to pick the best one suited for your needs and trip!

Before we give you some options, let’s go over some good tips when choosing a travel insurance and budgeting how much you can spend for it:

- Make sure you get the correct amount of travel insurance. This means that the amount you get correlates with the cost of your trip. You don’t want to be over-insured.

- Buy your insurance immediately after booking, so that you can get the most of your benefits. These benefits can come in the form of an increase in covered reasons for trip cancellations and/or a higher likelihood of coverage for instances from pre-existing medical conditions.

- Read every single part of your policy. This isn’t like the “Terms and Conditions” page you get when you download an app. The policy will dictate what can get covered under the insurance. It’s good to know beforehand, rather than finding out later that something you needed wasn’t covered.

- Use a travel advisor for guidance when choosing an insurance. They can help answer any and all questions you may have.

- Assess the medical coverage based on what you will need.

- Know for sure what isn’t covered by your plan.

- Understand what constitutes a “travel delay” so that you can be properly compensated if that issue arises.

Now, here are some travel insurance options out there.

American Express

American Express has customizable policies, flexible rates, and good customer service, which is great for if you need to file a claim (no one likes being on hold!). They offer travel insurance policies that are not available to their cardholders, like emergency medical coverage and travel accident protection in cases of death.

Allianz

Allianz has single-trip plans or annual plans for those who travel abroad often. They have what is called a CFAR (Cancel For Any Reason) policy that reimburses up to 80% of non-refundable, prepaid expenses.

Their OneTrip Prime plan includes travel interruption, emergency medical care, and emergency transportation. On top of this, children under 17 are covered for free when traveling with a parent or grandparent!

AIG

AIG’s Travel Guard is a great example of customizable coverage. Their mid-range plan pays out 100% for trip cancellations and 150% for trip interruptions.

They also give you up to $50k in medical expense coverage and up to $500k for emergency evacuation coverage. Furthermore, you can get a $1,000 payout for missed connections.

Faye

Faye is a travel insurance that is purely online, so claims are filed digitally. Their app makes it super easy to have your policy details on hand, which is great for traumatic situations. They have one of the most generous limits for travel delay coverage: $300 per day and $4,500 per trip.

There are some alternatives to travel insurance. Some credit cards have built-in insurance from the card provider, like

- Chase Sapphire Preferred Card,

- Southwest Rapid Rewards Plus Credit Card,

- And American Express Gold Card

With all the options aside, now is the important part. How much is this gonna cost me?

Well, costs vary between 4% and 10% of your trip. Plans with higher limits and more optional coverage tend to cost more.

Also, any CFAR benefit plans can cost up to 40% more. On top of this, older people usually have to pay more because there’s a higher chance of a claim being filed. These are all things to consider when getting travel insurance.

To Travel Insured or Uninsured? That is the Question.

When deciding whether or not to get travel insurance, consider these following questions:

- What are the chances that severe weather will impact my trip?

- How willing will I be to take risks on my trip that could cause potential injuries?

- How much am I willing to pay for a back-up plan if something goes wrong and I’m not insured?

- Do I or a loved one have questionable health at the moment?

Travel insurance is not a one-size-fits-all type of thing. Some policies work better for families, while others cater more towards single travelers. No matter what, make sure to do your research on what will be the most beneficial to you.

Explore the World and Have Fun Safely with ALLMYNE

A good place to start is by looking at what people in your life use. And with tools like SquareMouth, you can shave down your options to just one or two rather than traversing the land of travel insurance all on your own.

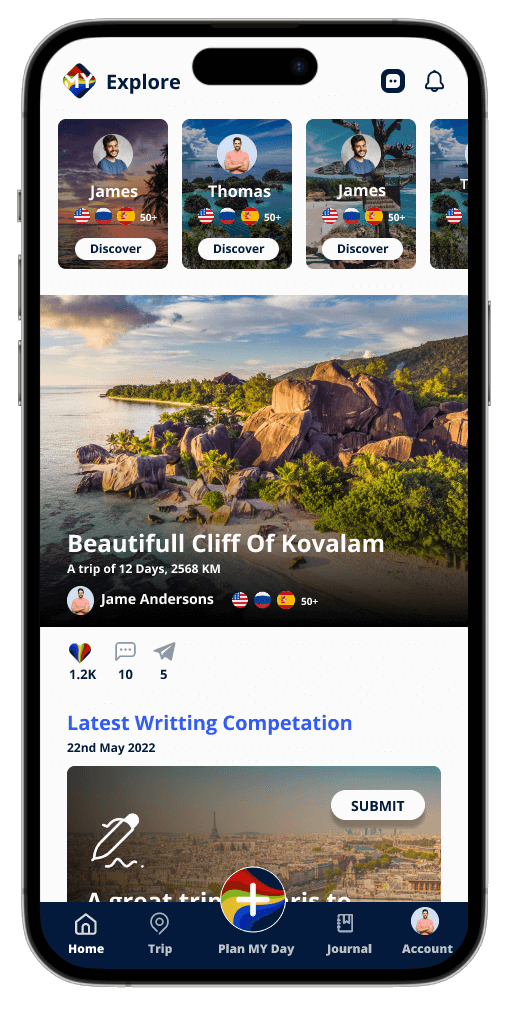

Download the ALLMYNE app from the APPLE STORE or GOOGLE PLAY to seamlessly plan, capture, and share your travel journey with a global community of fellow explorers.

Upgrade to our PRO subscriber level for even more perks, including audio recording in your journal, AI-powered location suggestions tailored to your interests, unlimited trip locations, and unlimited storage for all your travel memories. Download the ALLMYNE app now – the ultimate travel companion to enhance every step of your journey!